May 22, 2017.

What is an Ethereum token?

Before learning about Ethereum tokens, it is important to first understand the basics of Ethereum. Please see my beginner’s guide to Ethereum for those new to this concept entirely. Ethereum tokens are simply digital assets that are being built on top of the Ethereum blockchain.

Written by Linda Xie - Originally published at this link.

They benefit from Ethereum’s existing infrastructure instead of developers having to build an entirely new blockchain. They also strengthen the Ethereum ecosystem by driving demand for ether, the native currency of Ethereum, needed to power the smart contracts. This beginner’s guide should help those who are new to digital assets to understand Ethereum tokens at a high level and how they are different than Ethereum.

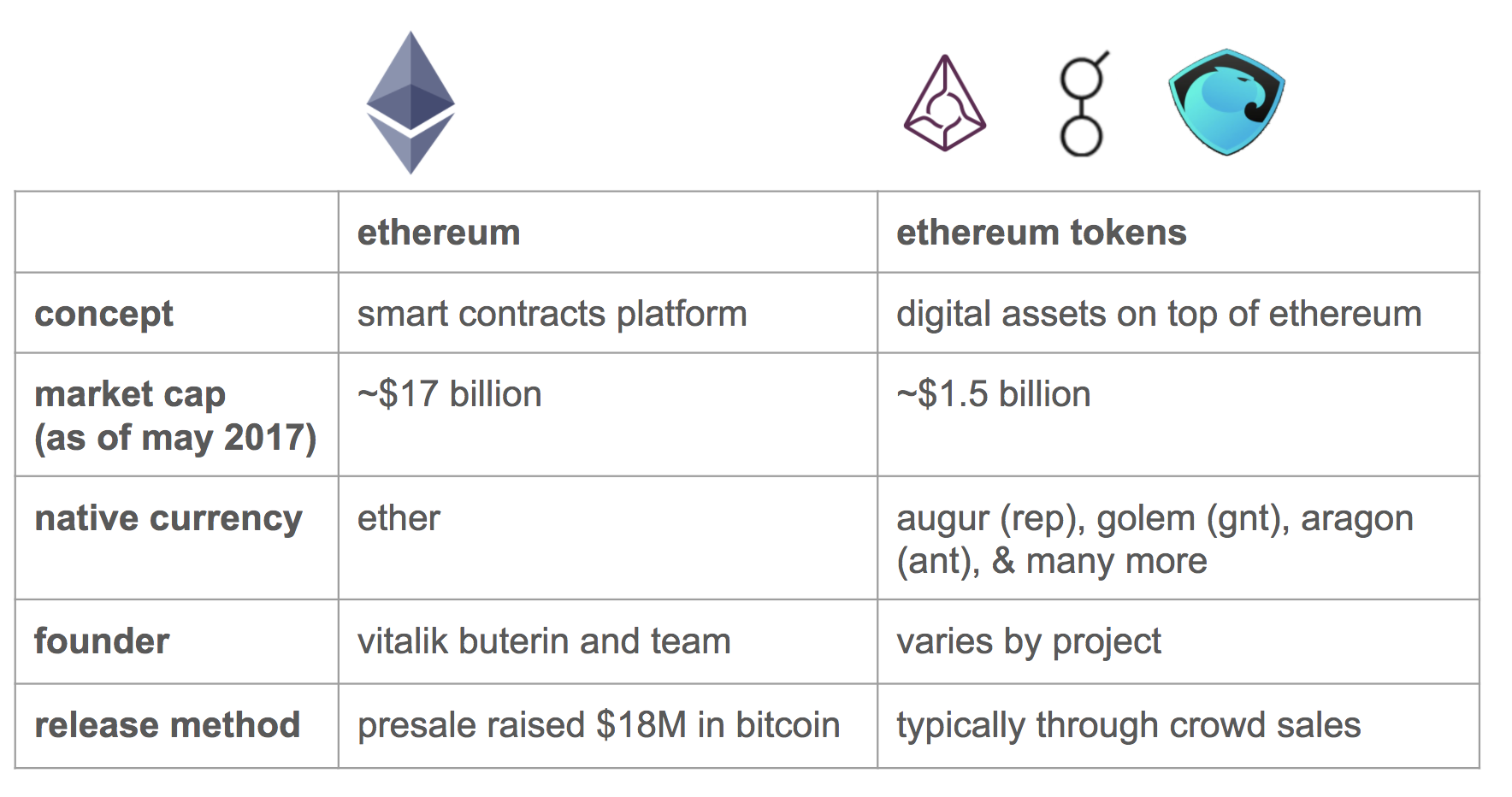

Comparison

Ethereum is a platform that can be used to create any arbitrary smart contract including smart contracts that represent digital assets called Ethereum tokens. This is similar to the App Store providing a platform for iOS apps with some apps issuing their own digital currencies that are used within the game or system. However, with Ethereum there is no centralized entity like Apple that controls what gets added to the App Store. Anyone can create a token on top of Ethereum.

Ethereum tokens can represent anything from a physical object like gold (Digix) to a native currency used to pay transaction fees (Golem). In the future, tokens may even be used to represent financial instruments like stocks and bonds. The properties and functions of each token are entirely subject to its intended use. Tokens can have a fixed supply, constant inflation rate, or even a supply determined by a sophisticated monetary policy. Tokens can be used for a variety of purposes such as paying to access a network or for decentralized governance over an organization.

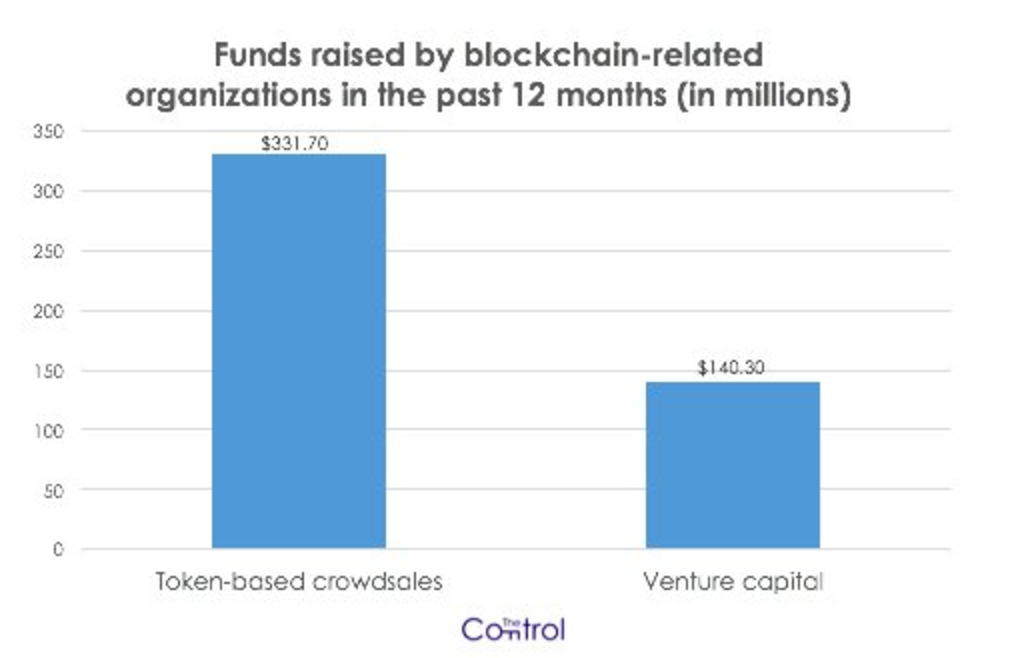

Tokens are often issued to the public through a crowd sale called an initial coin offering (ICO). The creators of the token will issue the token to others in exchange for ether and sometimes bitcoin and other digital currencies. There have been many ICOs recently and in a short time they have completely changed the way projects are funded. There is no requirement that tokens must be well distributed, although if you are building a decentralized application ideally you want the tokens to be owned by as many people as possible.

There are multiple resources that can walk you through the process of creating a token and that explain how tokens work on a technical level. For example, Token Factory provides a simple user interface that allows you to create your own Ethereum token with custom parameters.

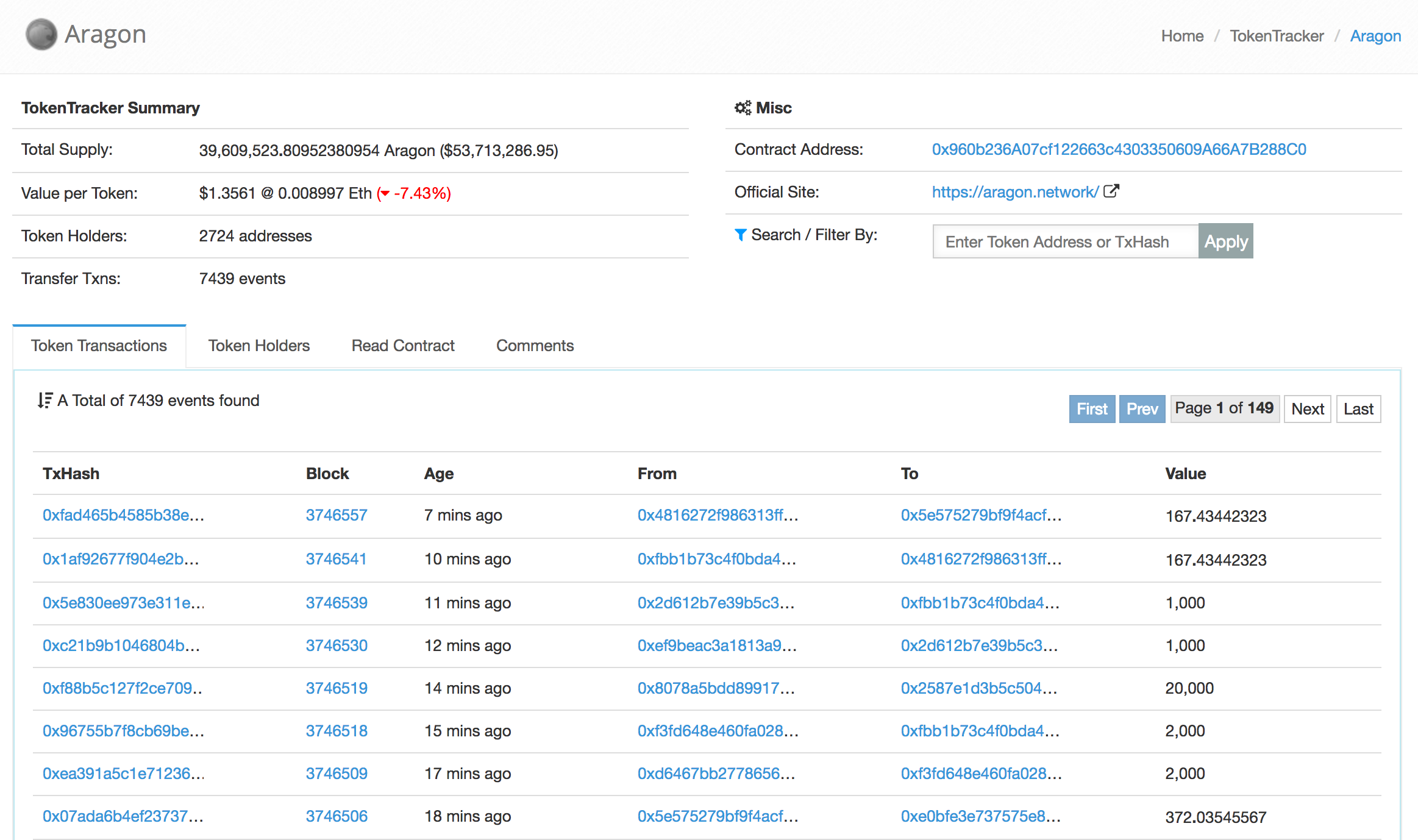

Similar to bitcoin and ether, Ethereum tokens are also tracked on the blockchain which is the public ledger of all transactions that have occurred. This is because Ethereum tokens are just a specific type of smart contract that live on the Ethereum blockchain.

Among the largest Ethereum tokens by market cap are Augur’s REP and Golem’s GNT. Both projects are in development and have a combined market cap of about $450 million. I’ll briefly go over how each of them work to provide a better understanding of the vastly different functions an Ethereum token can have.

Augur

Augur is a decentralized prediction market co-founded by Joey Krug and Jack Peterson. Prediction markets allow users to bet on the outcome of different events and can also be used for hedging purposes. For example, if you own 1 bitcoin that is worth $2,000 and want to hedge that holding, you can bet that the price of bitcoin will be below $2,000 by a certain date. That way if the price of bitcoin goes up your holdings will be more valuable but if it goes down you will offset your losses through the prediction market. There is no centralized source that reports on the outcome of events. This mitigates the risk of a corrupt reporter but also creates a need for a decentralized reporting source.

Augur issued an Ethereum token called Reputation (REP). There is a fixed supply of 11 million REP tokens in existence, 80% of which were sold through a crowd sale raising $5.3 million. These tokens are used for reporting on the outcome of prediction market events. All active REP holders are required to report on the outcome of randomly selected events. This maintains the decentralized reporting pool needed to settle the outcome of Augur’s prediction markets. As a reward for providing this critical reporting function, REP holders receive half of all transaction fees generated by prediction markets on the platform. If someone tries to lie and report on the outcome incorrectly then they will get penalized by having to give up some of their REP. In addition if the majority of REP holders are dishonest then people would not want to use Augur and the value of REP goes down. This incentivizes people to act honestly in the Augur system.

Golem

Golem is a project headed by Julian Zawistowski that allows people to rent out their spare computing power to others. The idea is that by creating a worldwide supercomputer, computing power will become less costly and more accessible to everyone.

Golem issued an Ethereum token called Golem Network Token (GNT). There is a fixed supply of 1 billion GNT in existence, 82% of which were sold through a crowd sale raising $8.6 million. These tokens are required for interacting with the Golem network and is the currency used as payment when renting computing power. Since there is a limited supply of tokens for accessing this network if more people want to use Golem then the value of GNT increases. This theoretically aligns the incentives of people holding GNT with those using it.

ERC20 token

You may hear the Ethereum community refer to ERC20 tokens. The initial ERC20 page “describes standard functions a token contract can implement.” ERC20 is a standard interface for tokens. ERC20 tokens are simply a subset of Ethereum tokens. In order to be fully ERC20 compliant the developer needs to incorporate a specific set of functions into their smart contract that at a high level will allow it to perform the following actions:

- get the total token supply

- get the account balance

- transfer the token

- approve spending the token

ERC20 allows for seamless interaction with other smart contracts and decentralized applications on the Ethereum blockchain. Tokens that have some but not all of the standard functions are considered to be partially ERC20 compliant and can still be easy for external parties to interact with depending upon which functions are missing.

Resources

There are many existing and upcoming Ethereum tokens. Below are some links that may help you understand Ethereum tokens further and keep up with the exciting news.

Understanding Ethereum tokens

- The difference between App Coins and Protocol Tokens

- How to Raise Money on a Blockchain with a Token

- Introducing the Blockchain Token Securities Law Framework

- Tokens, Tokens and More Tokens

- The Token Economy

- The perfect token sale structure

Keeping up with Ethereum tokens

Thank you to Will Warren and many Coinbase employees especially Jordan Clifford, Reuben Bramanathan, David Farmer, and Dan Romero.

Disclosure: The author owns various ethereum-based assets, including augur rep and golem gnt. All opinions in this post are the author’s alone. This post is not an endorsement by Coinbase of any asset and you should be aware of the risk of loss before trading or holding any digital asset.