January 14, 2016.

“Nothing can be so amusingly arrogant as a young man who has just discovered an old idea and thinks it is his own.” (Sidney J. Harris)

And this is why I am so amused by the non-stop fintech chatter.

Written by Gaurav sharma - Originally published at this link.

Credit is older than money. The money you see in your pocket is less than a few hundred years old. The Euro is just 16 years old while the US dollar is just 170 years old.

World history is nothing but a story of debtors and creditors.

The roots of credit and lending can be traced back to the origins of civilization itself. Written loan contracts from Mesopotamia which are more than 3,000 years old showed the development of a credit system that included the concept of interest. But the earliest records go all the way back to Assyria and Babylonia where merchants of the time made grain loans to farmers and traders. The mechanisms in place were pretty sophisticated, even by modern standards, with lenders accepting both deposits and acting a little like a bureau de change. More about it here.

In 1780 BC, the Code of Hammurabi defined a framework for lending in prehistoric times.

Only the tools and medium have changed

What has changed over thousands of years are the tools and medium of credit transactions – the means to acquire, deliver, assess and contain risk. Risk-based pricing is not new. Since the days of Guarantor-based loan to Collateral-based lending (house, gold, ornaments), the lenders have always figured out a way of risk assessment. Even though 4000 years old, the Code of Hammurabi talks about rate caps to prohibit usurious and predatory lending.

"Are the new digital lenders more efficient at allocating capital and selecting risks than banks?"

We are now in an age of new tools — with the internet, mobile, big data stacks, and machine learning. These new tools are for creating operational efficiency and data gathering. They do not change the risk, but only help in better risk selection. The new risk models have to be subjected to various credit cycles to test their robustness. More data is not equal to more insights.

Modern day banks were created for the purpose of better risk selection and capital allocation. So the question is, are the new digital lenders more efficient at allocating capital and selecting risks than banks?

It is to be noted that much has changed within the banking landscape — with regulation, changing customer expectations, technology, demographics, greater competition, legacy businesses and operating models.

Lending and risk are linked, but are two very different things

The most important thing that often gets ignored in this continuous din that is fintech, machine lending, big data, and alternative finance, is an adequate understanding of risk.

The medium is undergoing a change. Not lending. And certainly not risk.

The lending business has various components:

- Distribution (how to acquire and deliver)

- Risk assessment (risk and price)

- Operations (fulfilment and collections)

- Capital and treasury management.

The objective of any lending function is to ensure that

(Losses+ Costs (Operations + Costs of Funds))

If this ratio is maintained, then one’s portfolio (principal protection) and business will continue to grow. The key is to maintain the lowest cost of capital and risk with the highest volume possible.

We are witnessing a lot of innovation in acquisition models, and this is not limited to fintech and digital finance companies alone. The majority of digital lending platforms are marketplaces, with only a minority being ‘on-balance sheet’ lenders. Soon, Facebook, Google, and Amazon will start participating in origination, distribution and fulfillment of financial products. Are fintech players ready for these media and commerce giants?

Long lasting and sustainable differentiation can only be around proprietary risk models. However, among existing digital finance companies, no platform has undergone a full credit cycle. Hence, with limited data sets and performance metrics, their credit risk and pricing models are untested. The underwriting standards and risk management employed framework by some digital finance players are also unclear.

Credit fuels commerce

Consumer debt is the lifeblood of any economy. Credit fuels consumption and commerce. All modern nation-states are built on deficit spending.

Lenders funded grain shipments in ancient Athens and backed the new merchants of Italy and England. They supported Spain’s exploration of the New World and made possible the successful colonization of America. Bank credit fueled the Industrial Revolution, supplying the necessary capital to the new entrepreneurs in the late 20th century. Lending institutions have provided billions of dollars to finance the technology, communications, and healthcare industries.

Without capital, such life-enhancing industries would not exist, and home ownership would be impossible to all but the wealthiest people.

There is bank credit and non-bank credit, and both are subject to credit and economic cycles. Managing credit risk is always a complex challenge — one that becomes even more complex against a backdrop of market volatility and ever-changing regulatory guidelines.

The lending cycle exacerbates business cycles

The loans extended on ‘easier’ terms during expansions return to haunt the lenders as problem loans during market contractions.

What I hear a lot in fintech innovation is the wordplay on mobile, big data, and machine learning. While all tools are nice, these risk models are yet to be stress tested over an extended period during economic up-cycle, down-cycle, and flat cycle. Baselining and the stabilization of risk models should be proven over various volume, scale and customer segments. Risk-management therefore, is as much an art as it is a science.

Risk-management therefore, is as much an art as it is a science.

The informal lending universe leverages on trust and social networks. Walk into any village in Asia and chances are that you will find money lending happening in a non-tech environment. The micro finance universe operates on self help groups (SHG) and group lending norms — the ultimate social network.

The benefit of operational and risk innovation by digital lenders is that it leads to proven and sustainable superior metrics compared to existing banks. With the current set of fintech players (balance sheet first only) the metrics in OPEX are beginning to show benefits over a branch-based model. But that is a no-brainer, tech costs will always be less than that of physical branch infrastructures.

The jury is still out on credit-risk models. I agree that they might have more data sets, but loan and data-set performance is always good in an expansionary cycle. The stability of risk models is yet to be proven in a contraction cycle.

In India, the banks were running losses as high as 7–8% with 15% portfolio at risk on unsecured loan books in 2009 to 2011. The losses in China’s peer to peer lending sector were as high as 8–14%. To get more perspective, study the CIR indicator and Loan-Loss trajectory for significant digital finance players like Lending Club and Prosper.

The credit business is based on leverage. ‘Borrow (cheap) and lend (high)’. Lending companies and banks have to manage their losses and operating expense within that spread.

I will write a separate post on how risk assessment tools and applications work in an increasingly data-driven environment, and how large banks can leverage that and improve upon existing models.

Money supply and leverage in the world

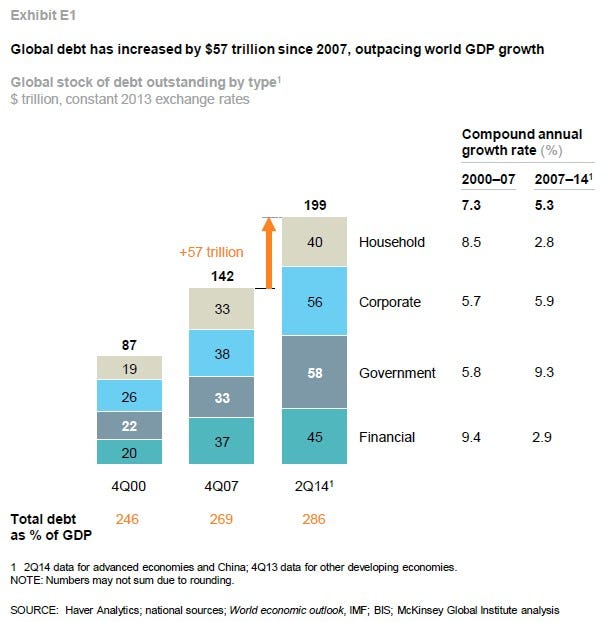

Since 1981, we have been in an expansionary cycle. The broad money supply has increased by $30 trillion in the last seven years. The debt leverage in the world has grown by $57 trillion since 2007. This poses new risks to financial stability and may undermine global economic growth.

High debt levels, whether in the public or private sector, have historically been a drag on growth and raised the risk of financial crises that spark deep economic recessions.

The world over central bankers and governments has been printing money. We are in a massive asset inflation market since 1981. The fact that government yields have peaked, and bonds, real estate, stock markets have all rallied is a powerful signal. Today, we live in a world of decelerating economic growth and accelerating productivity growth. There is too much leverage in the world now.

With bank lending constrained due to new regulations, non-bank credit has been growing. The rapid growth of shadow banking in China has become a huge concern.

People like me who study and work across emerging markets can see the pressure on lending balance sheets. We saw a little glimpse of that yesterday with a 7% market crash. What is happening in Chinese and Indian banking is just a glimpse of things to come. You might want to check the loss rates that peer to peer and alternative finance lenders are running, and this is in an expansionary credit cycle.

The new lending balance sheets have not been subject to a contraction. There is a long way before victory is declared. Don’t get me wrong, I am a big fan and supporter of all-things-fintech, however sometimes it helps to put things in perspective.

Step out of the frame to see the picture

Powerful forces — customer expectations, technological capabilities, regulatory requirements, demographics, and economics — are creating an imperative for the retail banking industry to change.

Predictably, there is a lot of action happening in the fintech space with tech media celebrating the birth of Bank Slayers. While it is nice to get carried away, it helps put things into perspective by stepping out of the frame.

1) Since 2010, digital banking startups around the world have received only $20 billion in funding (as per CB Insights), and a majority of digital lending platforms are marketplaces, with a minority being ‘on-balance sheet’ lenders.

2) Globally, in 2015, total money spent by banks in IT related costs was approx. $190 billion.

3) Banks made a profit of $1 trillion on capital of $10 trillion in 2014. 40% of that, $400 billion was in the form of credit interest income alone.

Many have predicted the death of the traditional bank, suggesting that disruptive new Digital Lenders will start offering a better customer experience through new products and channels.

I think banks will continue to exist in our generation, though their form, shape, and ownership would change.

While I do not doubt that, I will not write an obituary of the bank, as yet. I think banks will continue to exist in our generation, though their form, shape, and ownership would change. It is more a process of evolution than a revolution.

It will help if media echo chambers, practitioners, and influencers exhibit some maturity and start thinking of fintech ventures and banks as collaborators, working towards providing superlative customer experience and credit access to billions of ‘unbanked’ people in a very cost efficient way.

Rather than play a “fintech vs. bank” game, it is prudent to collaborate strategically and create more economic value for the world. It is important to put the customer back at the center.